The income tax dispute resolution mechanism (Income Tax litigation) in India is multi-layered and time-consuming, affecting the environment for running business in our country, India. The country has an exclusive tax appeals system that goes up to the Supreme Court of India. However, this system is subject to overuse. The income tax department is a significant generator of the tax appeals filed under the current dispute resolution procedure. On comparison with the other countries, India’s tax litigation numbers, pendency, and resolution times are significantly higher than the others. India’s income tax department has a meagre rate of success in its tax appeals compared with other countries of the world. India has been ranked overall at 63rd (from a list of 190 countries) in the World Bank’s Report on “Ease of Doing Business (EODB), 2020”. However, India still ranks below 100 on three of the eleven indicators used for the computation of the overall ranking of countries in the EODB Report; owing to enforcing contracts (163), registering property (154), and paying taxes (115).

The factors leading to rise in direct tax disputes

- Due to recent changes by the Indian tax authorities for increasing the tax base of India by emphasising tax deducted at source.

- Lack of clarity on new provisions by both taxpayers and tax authorities.

- Aggressive interpretations of the language of the law by both taxpayers and tax authorities.

- The different Appellate forums or the authorities across the country has given the rulings which not only conflicting with the provisions but also giving rise the unprecedented delays in tax disputes.

Tax Litigation Concept

As per Prof. Buchanan in Spring 2007, the tax litigation includes the following key elements: -

- Substance over form: pervades the entire tax law.

- Horizontal equity: those with the same ability to pay should pay the same.

- Vertical equity: those who can pay more, should.

- To the extent: means “by the amount of” (the amount that something exceeds something), not “if.”

- Tax avoidance: try to limit tax liability using reasonable arguments based on the code, e.g., partial reimbursement, expenses partially fully deductible and partially half deductible claim a full deduction claiming that the partial reimbursement was for the half deductible portion.

- Tax evasion: try to take aggressive positions to play with the words of the code, e.g., if you decide to deduct as expense something that was reimbursed, getting lots of income and not reporting it.

In Tax litigations, the substantive question of law must be formulated to file the appeal in the High courts and supreme courts. Generally, the sections 139 -153 (treated as procedural income tax laws) & sections 68-69 and many times disputes arise within these sections leading to the formulation of the substantive question of law.

Key operatives of the Section 68-69:

- Section 68 -Cash credits

- Section 69-Unexplained investments

- Section 69A–Unexplained money, etc.

- Section 69B -Amount of investments, etc., not fully disclosed in books of account

- Section 69C– Unexplained expenditure, etc.

The Significant Assessments under the Income Tax Act

- Assessment under section 143(1), i.e., Summary assessment without calling the assesse – The assessment under section 143(1) is preliminary checking of the return of income. At this stage, Income-tax returns are processed to correct arithmetical mistakes, internal inconsistencies, tax calculation and verification of tax payment.

- Assessment under section 143(3), i.e., Scrutiny assessment – Such assessment is a detailed assessment of total income or loss of the assesse, and determines the sum payable by him or any refund of the amount due to him based on such evaluations. The objective of a scrutiny assessment is to ensure that the taxpayers have not understated the income or have not computed any excessive loss or have not underpaid the tax in any manner.

- Assessment under section 144, i.e., Best judgment assessment – The assessing officer, after considering all the relevant materials, shall assess the total income or loss to the best of his judgement and then determine the sum payable by the assesse based on such assessment. The assesse will be given a reasonable opportunity of being heard by serving a show-cause notice and calling him upon on a specified date and time.

- Assessment under section 147, i.e., income escaping assessment - If the Assessing Officer has reason to believe that any income chargeable to income tax has escaped assessment, he may assess/reassess such income subject to provisions of sections 148 to 153. In such a case, a notice shall be issued under section 148. Such assessment shall not be made after the expiry of four years from the end of the relevant assessment year.

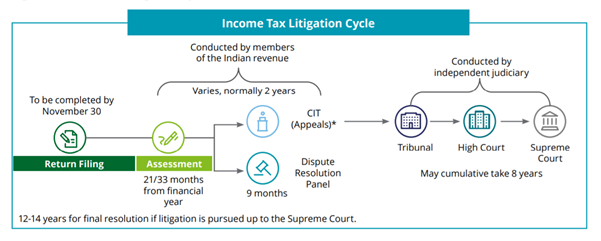

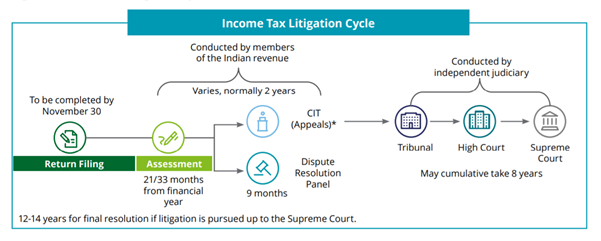

Income Tax Litigation Cycle

Typical dispute litigation routes the timelines and hierarchy. An innocent taxpayer, after receiving an assessment order, can take the appeal through four appellate forums which are-

- CIT (Appeals),

- ITAT,

- High Courts, and

- Supreme Court.

The current tax litigation process in India usually takes around 12-14 years (if the appeals go up to Supreme Court) to resolve the tax dispute. The time lag is mainly because no timelines are mandated for the conclusion of the proceedings at the appellate forums; there is significant workload, lack of fast-track dispute resolution mechanism, etc.

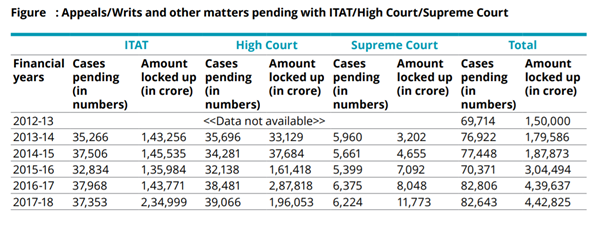

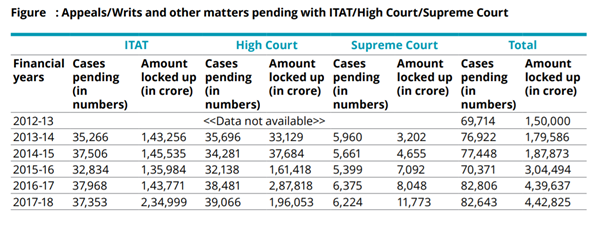

Facts and Figures

The “Annual Report of the Comptroller and Auditor General of India (C&AG)” on the Direct Tax regularly features data regarding the appeals/writs and such other matters pending before the ITAT or the High Court or the Supreme Court. The data from the FY 2012-13 onwards is shown in the below table:-

Forums to Facilitate Speedy Resolution of Tax Disputes

- Income Tax Settlement Commission - In addition to the appellate mechanism, income tax settlement commission was set up under section 245B of the Income Tax Act, 1961. This commission has the power to grant immunity from prosecution and imposition of any penalty in cases where the applicants make full and authentic disclosure of their income or wealth. The order passed by the Settlement Commission is as conclusive as to the matters stated therein, and no appeal lies to any of the authority against the order adopted by the Settlement Commission.

- Authority of Advance Ruling -The Authority of Advance Ruling (AAR) is a quasi-judicial body that helps in providing certainty on tax positions of high-value transactions in advance. It was set up to ascertain the income tax applicable or to withhold tax liability in advance, therefore, providing certainty and avoiding prolonged litigation. It may be for the completed transaction as well as for the proposed transaction.

- Withholding tax authorities - If the taxpayer believes that a particular transaction is not taxable in India, or taxable at a much lower rate than specified TDS rate, it may approach tax authorities for the certificate of smaller/nil deduction of TDS under section 197 of the Income Tax Act, 1961, to make the payment without deducting tax or deducting at a lower rate.

- Dispute Resolution Panel (DRP) - In the cases involving assessment of foreign companies and transfer pricing adjustments, the taxpayer can approach DRP if he has any objections against the proposed modification in the tax assessment. The DRP, after considering the objections and hearing both taxpayer and the Assessing officer, gives necessary directions.

An Overview of Revision of Monetary Limits:

The Central Board of Direct Taxes (CBDT) vide the Circular No. 18/2019 dated 18th August 2019 has made further enhancement in the monetary limits for filing Departmental Appeal at Tribunals, High Courts and the Supreme Court which are as follows:

|

Appeals/SLP in Income Tax Matters

|

Revised Tax Effect Limits

|

Earlier Tax Effect Limits

|

|

ITAT

|

Rs. 50 Lakhs

|

Rs. 20 Lakhs

|

|

HIGH COURT

|

Rs. 1 Crore

|

Rs. 50 Lakhs

|

|

SUPREME COURT

|

Rs. 2 Crore

|

Rs. 1 Crore

|