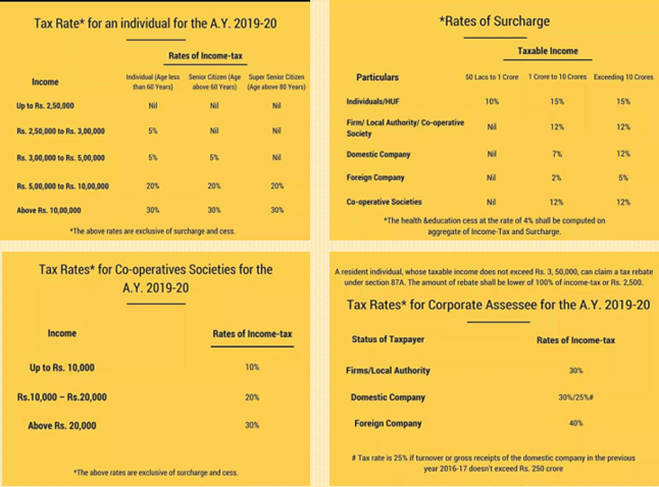

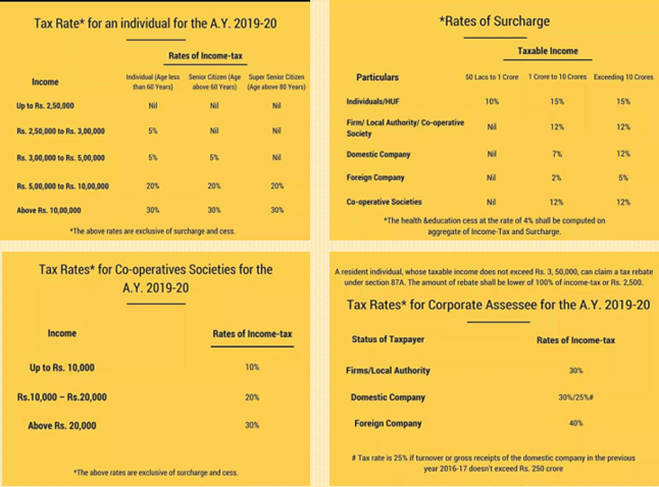

1. NO CHANGE IN TAX RATES & BASIC EXEMPTION LIMIT:

Tax rates continue to be same for AY 2019-20 as applicable for AY 2018-19. Further, there is no change in basic exemption limit.

2. HEALTH & EDUCATION CESS:

A new cess named ‘Health & Education Cess is proposed to be levied @4% of Income tax including Surcharge if applicable, in place of ‘Education cess & secondary & Higher Education cess’ on Income tax.

3. APPLICABLE RATES

4. EFFECT ON PERSONAL TAXATION:

A Standard deduction of maximum of Rs. 40,000 is proposed to be allowed to salaried employees in lieu of present exemption in respect of transport allowance and reimbursement of medical expenses. The net benefit is only Rs. 5,800 which would be further reduced due to increase in cess by 1%. However, benefit of enhanced transport allowance to differently able persons Shall be allowed.

5. DEDUCTION IN RESPECT OF INTEREST INCOME TO SENIOR CITIZEN:

A new section 80TTB proposed to be inserted to enhance such deduction to Rs. 50,000 from the existing limit of Rs. 10,000(U/S 80TTA) for senior citizens. Moreover, the benefit of such deduction is proposed to extended to interest on fixed deposits and recurring deposits

6. HEALTH INSUARANCE BENEFITS U/S 80D:

Section 80D proposed to be amended to increase such limit of deduction from Rs. 30,000 to Rs. 50,000 for resident senior citizens, who is of the age of 60 years or more during the previous year. Senior citizens not covered by insurance can claim reimbursement of medical expenditure upto Rs. 50,000. Earlier this benefit was available only for very senior citizens. Further, in case of single premium health insurance policies to effect or to keep in force an insurance on the health for more than a year, it is proposed that the deduction shall be allowed on proportionate basis for the number of years for which health insurance cover is provided, subject to the specified monetary limit.

7. ENHANCED DEDUCTION FOR MEDICAL TREATMENT OF SPECIFIED DISEASES:

It is proposed to increase deduction u/s 80DDB upto Rs. 1,00,000 for both senior citizens and very senior citizens in place of existing deduction upto Rs 80,000 and Rs. 60,000 in respect of very senior citizen and senior citizens, respectively.

8. EXTENDING THE BENEFIT OF EXEMPTION OF WITHDRAWAL FROM NATIONAL PENSION SCHEME TO NON EMPLOYEE SUBSCRIBERS:

The existing provisions of the clause (12A) of section 10 of the Act provides an exemption of 40% of the total amount payable to an employee contributing to the NPS on closure of his account or on his opting out. This exemption is not available to non-employee subscribers.

Proposed amendment: It is proposed to amend this section to extend the benefit of such exemption to all assesses. However, benefit of exemption under clause (12B) for partial withdrawal continues to be restricted to employees alone.

9. LONG TERM CAPITAL GAIN WHICH WAS EARLIER EXEMPT U/S 10(38) NOW TO BECOME TAXABLE(SEC-112A):

- Long term capital gain on sale of Listed equity shares/Equity oriented mutual fund through recognized stock exchange (STT paid) will now be subject to tax@10%, if such gain is in excess of 1,00,000/- Rs. This is proposed to be inserted from F.Y 18-19.

- Cost of Acquisition for the Capital Assets (Being Shares) acquired by the Assesse before 1st February 2018 shall be deemed to be the higher of - a) the actual cost of acquisition of such asset; and b) the lower of - (I) the fair market value of such asset on 31.1.2018; and (II) the full value of consideration received or accruing as a result of the transfer of the capital asset. Such capital gains would neither be eligible for benefit of Chapter VI-A deductions nor rebate u/s 87A.

- Further the provision of TDS is proposed to be levied on these gains.

10. CONVERSION OF STOCK IN TRADE INTO CAPITAL ASSET:

Section 28 is proposed to be amended to tax the profit or gains arising from conversion of inventory into capital asset or its treatment as business income. The full value of the consideration received or accruing as a result of such conversion would be fair market value of the inventory on the date of conversion determined in the prescribed manner. Further, for determining capital gain on transfer of such capital asset, the fair market value on the date of conversion shall be the cost of acquisition. The period of holding would be reckoned from the date of conversion or treatment. It may be noted that business income would be taxable in the year of conversion and there is no provision for postponement of taxability of income to the year in which the transfer took place.

11. PROPOSED AMENDMENT TO DETERMINE FULL VALUE OF CONSIDERATION IN CASE OF IMMOVABLE PROPERTY:

Section 50C, 43CA & 56 proposed to be amended to provide that no adjustments shall be made in a case where the variation between stamp duty value and the sale consideration is not more than 5% of the sale consideration. Till now Sale consideration or Stamp duty value, whichever is higher is adopted as full value of Consideration

12. DEDUCTION U/S 54EC:

- The limit of Exemption of Rs. 50,00,000/- will now be only for long term Capital Gain arising from transfer of land or building or both. It is proposed to restrict the scope of this section to long term capital gains arising from land and building.

- Period of Holding is also proposed to be increased from 3 years to 5 years.

13. INCOME TAX ACT TO BE AMMENDED FROM RETROSPECTIVE EFFECT TO BRING IT IN LINE WITH ICDS:

The Delhi High Court in case of Chamber of Tax Consultants & Anr Vs. Union of India & Ors has held that certain provisions of ICDSs are ultra vires. In order to bring certainty, the following amendments are proposed to be effected with retrospective effect from A.Y. 2017-18, in the Income-tax Act in line with the ICDS

- (Sec- 36 & 40A) ICDS I: Accounting Policies ICDS I provides that marked to market losses would not be allowed unless the same is in accordance with any other ICDS. Therefore, only Marked to market losses specifically permitted under any other ICDS would be allowable as deduction under section 36. Other marked to market losses would not be allowed as per section 40A.

- (Sec- 43AA) ICDS VI: Effects of changes in Foreign exchange rates Any gain or loss arising on account of effects of changes in foreign exchange rates in respect of specified foreign currency transactions shall be treated as income or loss.

- (Sec- 43CB) ICDS III: Construction Contract Profits arising from a construction contract or a contract for providing services shall be determined on the basis of percentage of completion method as per ICDS III except for certain service contracts. Contract revenue shall include retention money, and contract cost shall not be reduced by incidental interest, dividend and capital gains.

- (Sec-145A) ICDS II: Valuation of inventory shall be made at lower of actual cost or net realizable value computed as per ICDS II(Valuation of Inventories). However, inventories being securities not listed on a recognised stock exchange with regularity from time to time, has to be valued at actual cost initially recognised Other securities held as inventory would be valued at lower of actual cost or net realisable value.

14. EFFECT ON BUSINESS TAXATION:

DOMESTIC COMPANIES-

The benefit of concessional rate of corporate tax@25% is proposed to be extended to domestic companies whose total turnover or gross receipt in the previous year 2016-17 does not exceed Rs. 250 crores.

CHARITABLE TRUSTS-

- Last year, the post demonetization Union Budget witnessed changes in tax laws denying benefit of deductions from business income in respect of expenditure for which cash payment exceeds Rs. 10,000. However, such changes were not incorporated in the special taxation regime applicable to charitable trusts. Hence, charitable trusts were availing benefits even in respect of application of income by way of cash payments.

- Proposed amendment: This year, the restrictive provisions are proposed to be made applicable to charitable trusts governed by the special taxation regime under section 10(23C) and 11 and 12. Furthermore, non-deduction of tax at source would now attract disallowance in the hands of the charitable trust also. This is a positive measure for bringing charitable trusts into the digital net

15. DEDUCTIONS:

1. 80JJAA-

- A deduction of 30% is allowed in addition to normal deduction of 100% in respect of emoluments paid to eligible new employees who have been employed for a minimum period of 240 days during the year under section 80JJAA. However, the minimum period of employment is relaxed to 150 days in the case of apparel industry.

- Proposed amendment: Section 80JJAA proposed to be amended to extend this relaxation to footwear and leather industry. Further, the deduction of 30% would also be available for a new employee who is employed for less than the minimum period during the first year but continues to remain employed for the minimum period in subsequent year. Such deduction would be available from the subsequent year.

2. 80P-

- Provisions of 80P is to be extended to Farm Producer Companies having a total turnover of Rs. 100 crore.

16. DEEMED DIVIDEND U/S 2(22)(E) NOW TO BE TAXED IN THE HANDS OF COMPANY:

It is proposed to tax deemed dividend referred under section 2(22) (e) in the hands of company. Dividend distribution tax @30% without grossing up is proposed to be levied on the company

17. RETURN OF INCOME AND ASSESSMENT PROCEDURE:

- Section 80AC provides that no deduction would be admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE, unless the return of income by the assesse is furnished on or before the due date specified under sub-section (1) of section 139 of the Act.

- Proposed amendment: It is proposed to extend the scope of section 80AC to provide that the benefit of deduction under the heading 'C.-Deductions in respect of certain incomes' in Chapter VIA shall not be allowed unless the return of income is filed by the due date. It will now include in its scope section 80P, 80PA, 80QQB and 80RRB

18. NON INDIVIDUAL ENTITIES TO APPLY FOR PAN:

Section 139A proposed to be amended to provide that non-individual entities, which enters into a financial transaction of an amount aggregating to Rs. 2,50,000 or more in a financial year shall be required to apply to the Assessing Officer for allotment of PAN. Further, the managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office bearer or any person competent to act on behalf of such entities would also apply to the Assessing Officer for allotment of PAN.

19. COMPANIES TO BE PROSECUTED FOR FAILURE TO FURNISH RETURN EVEN IF THERE IS NO TAX LIABILITY( EARLIER RS.3000/- LIMIT) (SECTION- 276CC)

20. E-ASSESSMENTS-

The budget proposal to notify an electronic mode for assessment across the country will significantly reduce harassment of tax payers by the tax authorities and usher in greater efficiency and transparency in the assessment procedure.